Jan 26, 2022 | Entrepreneurs, News, Self Assessment, Small Business

We think you’d be hard-pressed to find two completely different professions as accounting and the creative industries. If you believe popular characterisations then you wouldn’t believe that we accountants could possibly enjoy working with creatives but you couldn’t...

Dec 22, 2021 | News, Small Business

When they start in business, most people have dreams of growing but there are some hidden traps that can stop those dreams from becoming reality. Everyone makes mistakes, but what we see are the same things coming up again and again. Some of them are pretty major and...

Jul 6, 2021 | Blog, Cashflow Management, Funding, HMRC, News, Small Business

Launched back in May last year, the government’s Bounce Back Loan scheme was designed as a temporary, emergency measure to financially support businesses during the coronavirus outbreak. The loans are 100% state backed with no repayments or interest due in the first...

Jul 5, 2021 | Blog, Cashflow Management, Professional Services, Small Business, Tax, VAT, Xero

If you own a professional services firm then you may have wondered whether Xero would be suitable for your needs. Professional services companies are different from other businesses in the way they operate and of course how they account for their time. This means that...

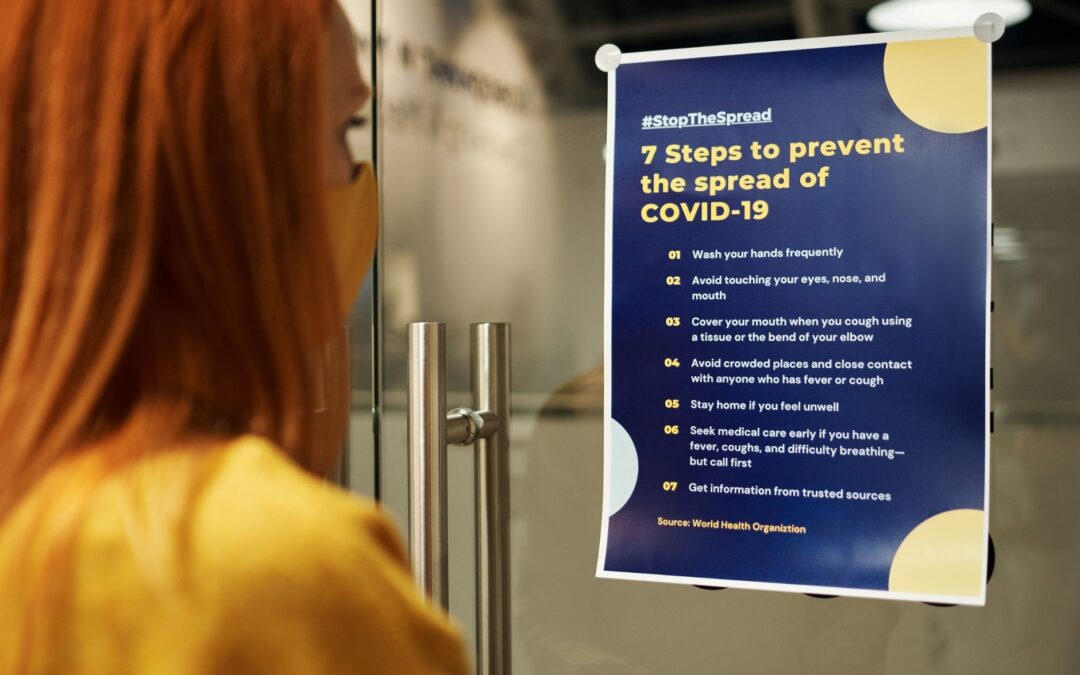

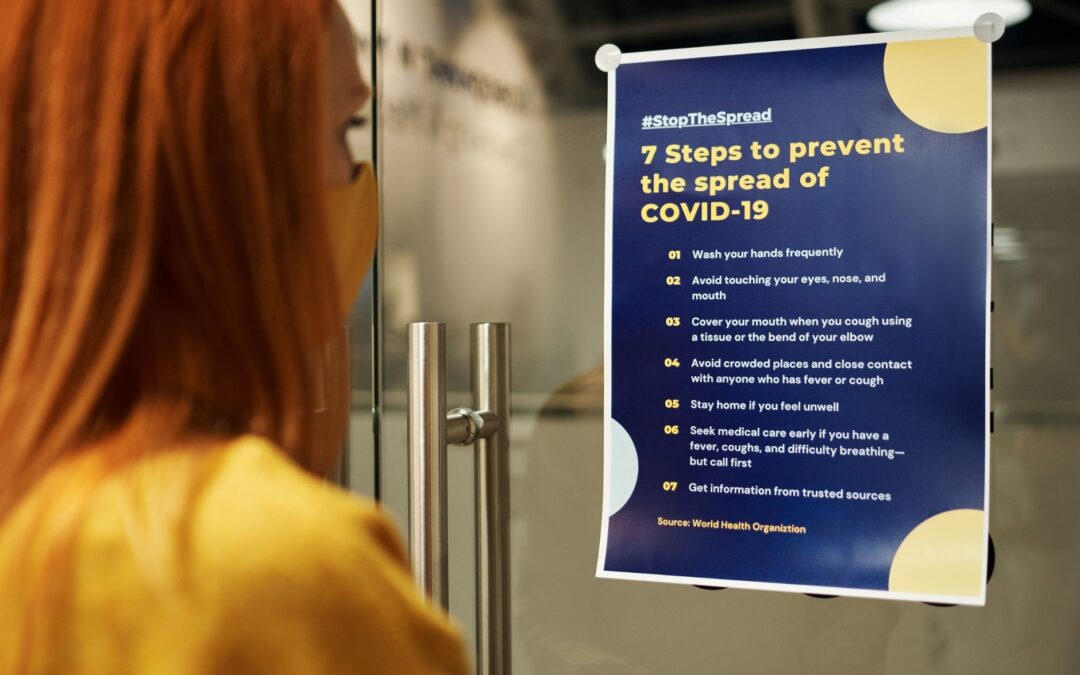

Feb 11, 2021 | Blog, Business Performance, Business Strategy, Entrepreneurs, Small Business

Living through unprecedented times is difficult for everyone but coupled with the added pressure of trying to operate a business simultaneously, it can feel overwhelming. Over the last several months, companies all over the country (and the rest of the world) have had...

Jan 21, 2021 | Blog, Small Business, Tax, Technology

Scams and fraudulent activity are notoriously hard to spot – that is, after all, why they work so well. Scammers are malicious, quick to adapt and are always coming up with new ways to pose as trusted organisations, concealing their real agenda from their victims....