Blog & News

Insights & News from Your Finance TeamWe spend a lot of time offering our clients practical advice on how they can grow their businesses – please see some of our articles below and feel free to share.

6 Ways Dext Can Benefit Your Business

How many hours a week do you spend manually inputting information from your bills and receipts to keep your accounts up to date? Five? Ten? This tedious task can be incredibly time-consuming and takes away from other essential responsibilities – like growing your...

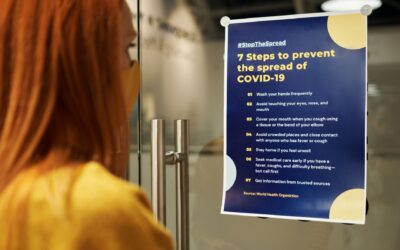

read moreOperating through a Pandemic: Key Lessons for Businesses

Living through unprecedented times is difficult for everyone but coupled with the added pressure of trying to operate a business simultaneously, it can feel overwhelming. Over the last several months, companies all over the country (and the rest of the world) have had...

read moreHow to Build your Perfect Home Office

As the pandemic continues to restrict our lives, working from home looks like it may be our ‘new normal’ for some time to come, and while it does have its benefits (goodbye, office commute!), it can be difficult to get to grips with. While some elements of working...

read moreSpotting Scammers: Protecting your Business from Fraudulent Activity

Scams and fraudulent activity are notoriously hard to spot – that is, after all, why they work so well. Scammers are malicious, quick to adapt and are always coming up with new ways to pose as trusted organisations, concealing their real agenda from their victims....

read moreHow to be Most Effective When Working from Home

Working from home is a position in which many of us have unexpectedly found ourselves this year. Some of us have relocated to dining room tables; others are holed-up in spare bedrooms, laptops balanced on piles of books; some are juggling meetings and childcare all at...

read moreBenefits of Hiring a Virtual Finance Director

As your business grows, so will the need for effective financial management. You may already have hired a bookkeeper to keep the basics in check, but as your business continues to prosper, you may feel that you need a more substantial service. This next step could be...

read moreImportance of Setting Goals and Objectives for the New Year

Fun fact: those who set goals and objectives are far more likely to succeed than those who don’t. Don’t believe us? Check this out… A group of researchers at the Harvard Business School conducted a study into the benefits of goal setting and found that those who set...

read moreHow Cashflow Forecasting Can Contribute to a Positive New Year

While the last few months of the year can be challenging to navigate for the majority of business owners, that's when is time to be looking forward to the following year and thinking of ways to increase the likelihood of a positive new financial year. One of the best...

read moreHow to Practice Mindfulness in the Workplace

Through the COVID crisis, Your Finance Team have concentrated on supporting clients with advice on their company finances and making sure they understand the government support available. However, more than ever, we have seen how COVID has created real anxiety amongst...

read moreYour Finance Team Achieves Xero Gold Partner

Xero is an incredibly fast-growing cloud-based accounting software that Your Finance Team (YFT) has been using for the past 5 years and has consistently grown its expertise and client base alongside its own growth and popularity. Xero allows companies to keep control...

read moreCan You Buy an Electric Car Through Your Company?

Should You Buy an Electric Car Through Your Company? A company car is one which is purchased and owned by a company but made available for private use by an employee. Successive governments have increased the personal tax costs of company cars which has meant that...

read moreMaking Tax Digital – are you ready?

Making Tax Digital or MTD is one of the furthest reaching HMRC initiatives of the past 20 years, which makes it all the more surprising that a recent British Chamber of Commerce survey discovered that nearly a quarter of British businesses surveyed had no knowledge of...

read more